Online shopping and e-commerce has exploded in India for the past few years and it is good for the consumers.

Let's look at how it would benefit the consumer while save money.

Comfort:

One of the best advantages of shopping online is comfort.

A typical shopping experience in physical stores would be to plan for where to go, how to go, hassle of driving or booking a cab, spending time and energy, standing in queues etc.

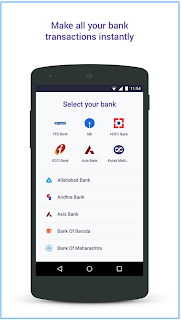

However online shopping makes it easy for one to just open a browser, select the item needed and pay for it using a credit/debit card, wallet or have Cash on Delivery.

Savings:

Almost always these days you can find an item cheaper online. Whether it be a mobile, electronics, books or anything else.

How are the companies able to provide such discounts ?

One, they are being efficient but the bigger reason is that they are subsidising the costs for consumer so they can grow their business.

It doesn't matter at the end of the day. Consumer is looking for the best offer and online websites provide it.

How to find a good discounted offer:

There are a number of ways to find the best price online.

Comparison engines: Mysmartprice, Use an extension like BuyHatke

Deals websites: DesiDime, CouponDunia

Cashback websites: GoPaisa

I will detail some of the above in a post later.

Use the resources available for you to get the best deal out of your shopping. However make sure you don't become an addict for things.

Let's look at how it would benefit the consumer while save money.

Comfort:

One of the best advantages of shopping online is comfort.

A typical shopping experience in physical stores would be to plan for where to go, how to go, hassle of driving or booking a cab, spending time and energy, standing in queues etc.

However online shopping makes it easy for one to just open a browser, select the item needed and pay for it using a credit/debit card, wallet or have Cash on Delivery.

Savings:

Almost always these days you can find an item cheaper online. Whether it be a mobile, electronics, books or anything else.

How are the companies able to provide such discounts ?

One, they are being efficient but the bigger reason is that they are subsidising the costs for consumer so they can grow their business.

It doesn't matter at the end of the day. Consumer is looking for the best offer and online websites provide it.

How to find a good discounted offer:

There are a number of ways to find the best price online.

Comparison engines: Mysmartprice, Use an extension like BuyHatke

Deals websites: DesiDime, CouponDunia

Cashback websites: GoPaisa

I will detail some of the above in a post later.

Use the resources available for you to get the best deal out of your shopping. However make sure you don't become an addict for things.